Happy New Year – wow, 2024! January in Mexico is more than just amazing weather and whale watching. For homeowners, it is time to pay property taxes and receive a twenty percent discount. Mexican property taxes are known as ‘predial impuesto’; like most other counties and municipalities, these taxes are used to operate local governments. Property taxes are assessed annually at approximately 3 per 1,000 of the municipal evaluation of the property. You may pay your property taxes at any time during the year. However, there is a discounted rate if they are paid early: 20% in January, 15% in February, 10% in March, and 5% in April. With this being said, it is sometimes easier to say than to do.

In Los Cabos, property tax statements are not sent out by mail, nor are they sent electronically. One must go to the local city hall (Oficina Catastral) or go on the Los Cabos Municipal website and input your property tax ID number (Clave Catastral). Property tax files are recorded by the tax number, not the property or deed holder’s name; one may want to check the Oficina Catastral records to ensure the correct name is associated with the property. You can find your property tax ID number (Clave Catastral) in your property Fedeicomiso or Mexican deed.

The Municipality offers different ways to pay taxes: 1. Going to one of the three offices opened to the public, 2. Go to the Bancomer Bank branches in Mexico or pay online with the charge to your credit card.

To pay with a credit card, the steps are:

1. Click on the following link: https://www.tesoreria.loscabos.gob.mx/pagos-y-consultas/

2. Scroll down, this image will be on the left side:

Click on Bancomer

3. Type in the property tax number where it says “INTRODUZCA CLAVE.” If you are unsure of the property tax number, please let your Property manager know. Then click on the red button “BUSCAR.”

4. Your statement should come up. Take a minute to read it and confirm it is under your name and the amount to pay is correct.

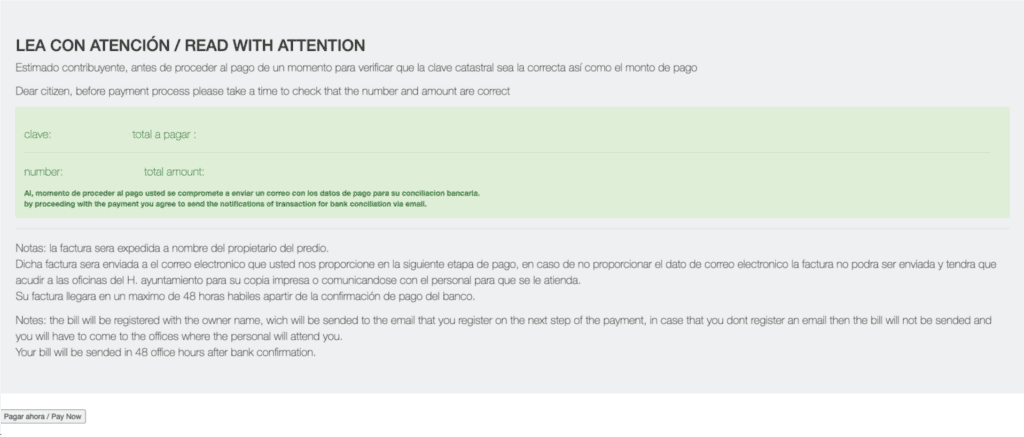

5. For payment, click on the ‘red icon’ which says “Pagar”, this means pay. Payment instructions in both English and Spanish should be here. You will see an image like this:

Please confirm your tax code is correct and the amount you will pay. At the end of the page, you will see a “Pague ahora / Pay now” grey button; click on it.

6. On the next page, you will need to fill in the following information on this order:

CREDIT CARD 16 DIGIT NUMBER

EXPIRATION DATE (month and year)

CREDIT CARD HOLDER’S NAME

SECURITY CODE (THE 3 DIGITS ON THE BACK OF YOUR CARD).

Add the address (this could be your property address in Los Cabos or address back home), and email address (CORREO ELECTRÓNICO).

NOTE – if a blank page appears, your computer may be blocking pop-ups – go to ‘Settings’ and allow Pop-ups. If your credit card is declined, check the number, available limit, and expiration date, or contact your bank.

7. Confirm payment and save or print your receipt – be sure it is under your name and is the correct amount. This is a critical step, as you cannot return to the website for a receipt.

Should you not save it, you must go to the property tax office (Oficina Catastral) and request a receipt.

If you have any further questions, contact your property manager, or if you are in Los Cabos, visit the Property tax office – If you need additional help, one of our choices in property management is Casita Keepers – casitakeeper@gmail.com +52.624.174.9260 or +1.970.587.3257

A simple email or call will help to facilitate paying this bill for you.

If you have any real estate questions or concerns – please feel free to contact me. Our Los Cabos market remains brisk as growth continues – there are some great opportunities in all price ranges.